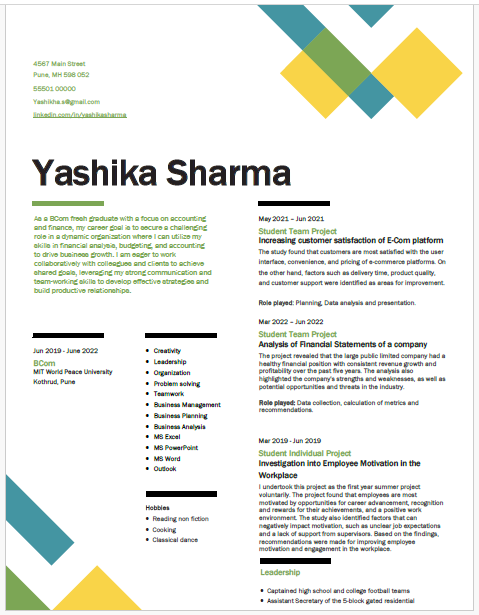

Accountant

B.Com

About this template

This is a well-designed resume which can make a significant difference in capturing the attention of hiring managers and landing your dream job.

Its clean design ensures easy readability, making it easier for recruiters to quickly assess your qualifications. This resume is tailored to make a strong impression and increase your chances of landing your desired job.

Some useful and most common interview questions for B.com accountant

Here are ten useful and common interview questions for a B.Com accountant, along with suggested answers :

1. Can you explain the basic principles of accounting?

Accounting principles include concepts like accruals, matching, and consistency. Accrual accounting recognizes revenues and expenses when incurred, matching ensures expenses are matched with revenues generated in the same accounting period, and consistency requires using the same accounting methods consistently.

2. How do you handle financial statement preparation?

I prepare financial statements such as the balance sheet, income statement, and cash flow statement by gathering financial data, reconciling accounts, and applying accounting standards like GAAP or IFRS. This involves ensuring accuracy, clarity, and compliance with regulatory requirements.

3. What is your experience with financial analysis and reporting?

I analyze financial data to assess the company's financial health, profitability, and performance trends. I create reports and presentations that highlight key metrics, variances, and recommendations for management decision-making.

4. How do you ensure accuracy in financial transactions and records?

I maintain accuracy by performing regular reconciliations, conducting audits, and adhering to internal controls. Attention to detail and thorough documentation are essential to minimize errors and ensure financial data integrity.

5. Can you describe your experience with budgeting and forecasting?

I participate in budgeting processes by preparing budget proposals, monitoring expenditures, and analyzing variances. Forecasting involves predicting future financial outcomes based on historical data and market trends to support strategic planning.

6. How do you stay updated with accounting standards and regulations?

I stay informed by attending professional development courses, reading industry publications, and participating in webinars. This ensures I understand and apply current accounting standards, regulations, and changes in tax laws.

7. Describe a challenging accounting problem you've faced and how you resolved it.

I encountered a complex reconciliation issue involving discrepancies in accounts receivable. I conducted a thorough investigation, identified accounting errors, and implemented corrective measures. This resolved the issue and improved accuracy in financial reporting.

8. What software and tools are you proficient in?

I am proficient in accounting software such as QuickBooks, SAP, or Xero for recording transactions, generating reports, and managing financial data efficiently. Advanced Excel skills allow me to perform complex financial analysis and modeling.

9. How do you prioritize tasks and manage deadlines in a fast-paced environment?

I prioritize tasks based on urgency, importance, and deadlines. I use organizational tools like calendars and task lists to plan and allocate time effectively, ensuring timely completion of financial reporting and compliance requirements.

10. What do you consider the most challenging aspect of being an accountant?

The most challenging aspect is ensuring accuracy and compliance while adapting to changes in regulations and accounting standards. Effective communication with stakeholders and keeping abreast of industry trends are crucial to overcoming these challenges.