Financial Analyst

Bachelor of Business Administration

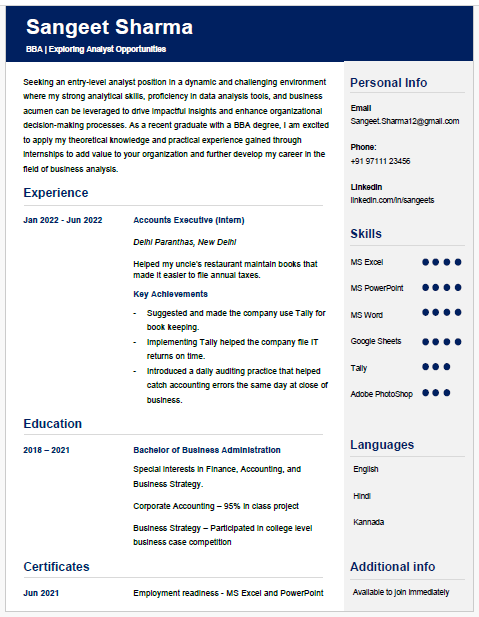

About this template

This is a very simple and professional resume which can effectively highlight your skills and experiences in a clear and concise manner.

This resume is made by MS Word, featuring a clean and modern layout designed to highlight your skills and achievements. Tailored to your industry, it ensures you stand out to recruiters and make a lasting impression.

Some important and common interview questions for entry level Financial analyst

For entry-level financial analysts, interview questions typically focus on assessing analytical skills, understanding of financial concepts, and the ability to communicate insights. Here are ten important and common interview questions:

1. Can you explain the difference between a balance sheet and an income statement?

This question tests your understanding of basic financial statements. You should explain that the balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time, while the income statement shows the company’s financial performance over a period, detailing revenues and expenses.

2. How do you perform a financial analysis on a company?

Interviewers want to gauge your approach to financial analysis. Discuss the steps you take, including reviewing financial statements, calculating key ratios (like P/E ratio, ROE, and debt-to-equity ratio), and assessing trends over time to understand the company’s financial health and performance.

3. What is a cash flow statement, and why is it important?

This question assesses your understanding of cash flow management. Explain that a cash flow statement provides insights into the cash generated and used by a company during a specific period, highlighting its operating, investing, and financing activities. It’s crucial for assessing liquidity and the company’s ability to sustain operations.

4. Can you describe a time when you used data to make a recommendation?

Here, the focus is on your analytical and decision-making skills. Share an example, perhaps from an internship or academic project, where you analyzed data, drew conclusions, and made a recommendation that added value or solved a problem.

5. What financial metrics would you consider important when evaluating a potential investment?

This question tests your understanding of key financial metrics. Discuss metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), Earnings Per Share (EPS), and Price-to-Earnings (P/E) ratio, explaining how they help assess the viability and profitability of an investment.

6. How do you ensure the accuracy of your financial reports?

Accuracy is critical in financial analysis. Describe your process for double-checking calculations, cross-referencing data sources, and reviewing reports for consistency and accuracy. Mention any tools or software you use to minimize errors.

7. Can you explain the concept of risk management in financial analysis?

This question assesses your understanding of risk assessment. Discuss the identification, analysis, and mitigation of financial risks, such as market risk, credit risk, and operational risk. Highlight the importance of balancing risk and return in investment decisions.

8. What experience do you have with financial modeling?

Interviewers want to know about your practical skills. Explain any experience you have building financial models, forecasting revenues, and expenses, or using tools like Excel for scenario analysis and sensitivity testing.

9. How do you keep up with current financial news and trends?

This question evaluates your commitment to staying informed. Discuss the resources you use, such as financial news websites, industry publications, professional forums, and any memberships in finance-related associations.

10. Why are you interested in a career as a financial analyst?

Here, you should convey your passion for finance and analysis. Share your motivation, whether it’s an interest in financial markets, a desire to help businesses grow through sound financial advice, or a fascination with data analysis and its real-world applications.

Conclusion :

These questions help interviewers assess an entry-level financial analyst's knowledge of financial concepts, analytical abilities, and passion for the field. Preparing well-thought-out answers will demonstrate your readiness for the role and your enthusiasm for a career in finance.