Finance

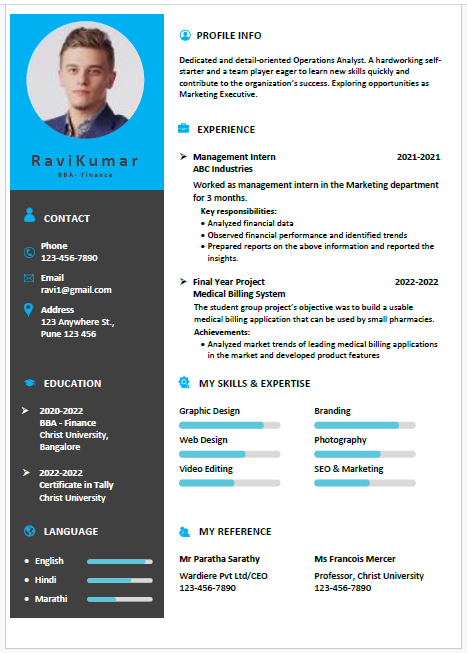

BBA- Finance

About this template

This resume is tailored to make a strong impression and increase your chances of landing your desired job.

Its clean design ensures easy readability, making it easier for recruiters to quickly assess your qualifications.

Some most common job roles for BBA, Finance

For BBA graduates specializing in finance, there are various job roles that leverage their academic background and skills in financial management, analysis, and operations. Here are ten common job roles along with the key skills required for BBA graduates with a finance concentration:

1. Financial Analyst:

Financial analysts are responsible for reviewing financial data, preparing reports, and helping to make budgetary and investment decisions. Skills in data analysis, financial modeling, and report writing are crucial.

2. Investment Banker:

Investment bankers assist organizations in raising capital by issuing stocks and bonds, and advising on mergers and acquisitions. Strong analytical skills, understanding of market trends, and knowledge of regulatory environments are essential.

3. Credit Analyst:

Credit analysts assess the creditworthiness of individuals or corporations. This role requires proficiency in analyzing financial statements, understanding risk management, and having strong decision-making skills.

4. Bank Branch Manager:

Bank branch managers oversee the operations of a branch of a bank, including managing staff and meeting financial targets. Leadership skills, customer service, and a deep understanding of banking products are necessary.

5. Personal Financial Advisor:

Personal financial advisors provide clients with advice on investments, insurance, mortgages, college savings, estate planning, taxes, and retirement. Skills in financial planning, communication, and client service are key.

6. Risk Manager:

Risk managers identify and analyze the risks to the assets, earning capacity, or success of organizations. They need to be adept at problem-solving, quantitative analysis, and regulatory compliance.

7. Portfolio Manager:

Portfolio managers oversee a collection of investments and manage the portfolio to achieve an investment objective. This role demands expertise in investment strategies, market research, and asset management.

8. Treasury Analyst:

Treasury analysts manage the organization’s funds, including operations, financial planning, and risk management. Skills in cash management, financial forecasting, and strategic planning are required.

9. Compliance Officer:

Compliance officers ensure that companies comply with external regulatory and legal requirements as well as internal policies and bylaws. Attention to detail, knowledge of legal and regulatory guidelines, and strong ethics are necessary.

10. Insurance Underwriter:

Insurance underwriters evaluate the risks of insuring people and assets and establish pricing for accepted insurable risks. Analytical skills, decision-making abilities, and knowledge of insurance principles are crucial.

Conclusion:

These roles span various sectors and require a mix of analytical, technical, and interpersonal skills, allowing BBA Finance graduates to apply their knowledge in practical settings, contributing to their organizations' financial health and stability.