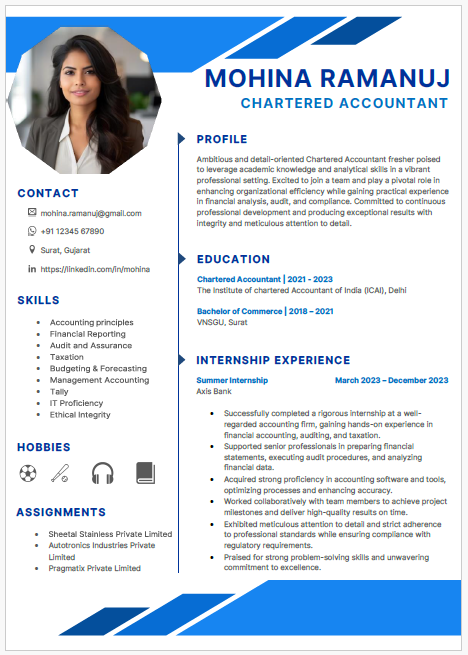

Chartered Accountant

Chartered Accountant

About this template

This is a well-designed resume which can make a significant difference in capturing the attention of hiring managers and landing your dream job.

This is a very colorful and modern resume which can help you stand out from the competition. Its vibrant design and well-organized layout effectively showcase your skills and achievements, making a lasting impression on potential employers.

Some important and useful technical skills for chartered accountant

Chartered Accountants (CAs) play a critical role in financial management, accounting, auditing, and taxation. To excel in these areas, they need a strong foundation in various technical skills. Here are ten important and useful technical skills for Chartered Accountants:

1. Accounting Standards Proficiency:

CAs must have an in-depth understanding of International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). This knowledge is crucial for preparing accurate financial statements and ensuring compliance with global accounting norms.

2. Financial Analysis and Reporting:

Proficiency in financial analysis involves interpreting financial data, assessing financial performance, and preparing detailed reports. CAs use these skills to provide insights on profitability, liquidity, and overall financial health to stakeholders.

3. Taxation Expertise:

CAs need a thorough knowledge of tax laws and regulations, including income tax, GST, and corporate tax. This expertise is essential for tax planning, compliance, and advising clients on tax-efficient strategies.

4. Auditing and Assurance:

Skills in auditing involve examining financial statements and systems to ensure accuracy and compliance with laws and regulations. CAs use these skills to conduct internal and external audits, identifying areas for improvement and ensuring financial integrity.

5. Cost Accounting:

Understanding cost accounting helps CAs analyze the costs of production, operations, and services. This skill is crucial for budgeting, cost control, and decision-making related to pricing and financial planning.

6. Financial Modeling:

Financial modeling skills involve creating models to forecast future financial performance, assess investment opportunities, and support strategic decision-making. CAs use these models to analyze different scenarios and provide data-driven insights.

7. Budgeting and Forecasting:

Proficiency in budgeting and forecasting allows CAs to prepare financial plans, estimate future revenues and expenses, and set financial goals. These skills are vital for effective financial planning and resource allocation.

8. Risk Management:

CAs need to identify, assess, and manage financial risks, including market, credit, and operational risks. This involves developing risk mitigation strategies and ensuring the organization's financial stability.

9. ERP Systems Proficiency:

Familiarity with Enterprise Resource Planning (ERP) systems like SAP, Oracle, or Microsoft Dynamics is essential for managing financial data, streamlining accounting processes, and enhancing data accuracy.

10. Data Analysis and Business Intelligence:

Skills in data analysis and business intelligence tools, such as Excel, Power BI, and Tableau, are increasingly important for CAs. These tools help analyze large datasets, generate insights, and support data-driven decision-making.

Conclusion

These technical skills are crucial for Chartered Accountants to perform their duties effectively, provide valuable financial insights, and maintain compliance with regulatory standards. They enable CAs to navigate complex financial environments and contribute to the strategic success of their organizations.