Chartered Accountant

Chartered Accountancy

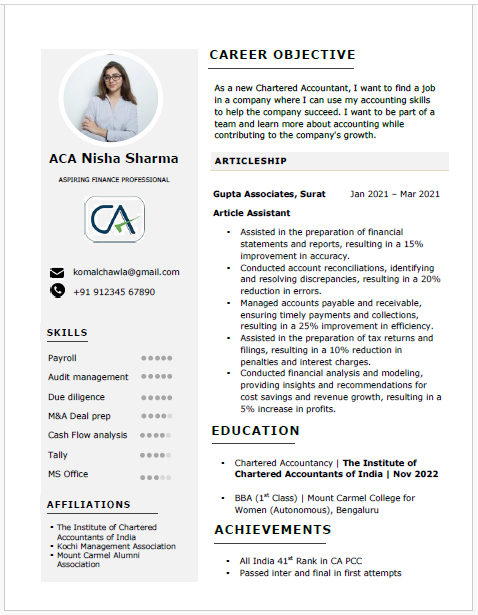

About this template

This is a very professional resume which can significantly enhance your job prospects.

With its clean, modern design and industry-tailored layout, it highlights your skills and achievements, making a strong impression on recruiters.

Some important and useful technical skills for CA

For a Chartered Accountant (CA), technical skills are crucial in ensuring accuracy, compliance, and efficiency in financial management. Here are ten important and useful technical skills for CAs:

1. Financial Accounting:

Mastery in financial accounting is fundamental for CAs. This skill involves understanding accounting principles, preparing financial statements, and ensuring accurate representation of a company's financial position in accordance with relevant standards.

2. Taxation Knowledge:

Expertise in tax laws and regulations is essential. CAs must stay updated with the latest tax codes, manage tax filings, and advise clients on tax planning and compliance to minimize liabilities and avoid penalties.

3. Auditing Skills:

Proficiency in auditing is crucial for verifying financial statements and ensuring compliance with statutory requirements. This involves understanding audit procedures, risk assessment, and internal control evaluation.

4. Cost Accounting:

Knowledge in cost accounting helps in analyzing and controlling costs within an organization. CAs use this skill to provide insights into cost behavior, cost allocation, and profitability analysis, aiding in strategic decision-making.

5. Financial Analysis and Reporting:

CAs must be skilled in financial analysis to interpret data and assess business performance. This includes ratio analysis, cash flow analysis, and preparing management reports to inform strategic decisions.

6. Budgeting and Forecasting:

Competence in budgeting and forecasting is vital for planning and controlling financial resources. CAs develop budgets, project future financial performance, and provide variance analysis to keep the organization on track.

7. Compliance and Regulatory Knowledge:

Understanding regulatory frameworks and compliance requirements is essential. CAs ensure that financial practices adhere to laws and regulations, including corporate governance and ethical standards.

8. Information Technology Skills:

Familiarity with accounting software like SAP, QuickBooks, and Excel is crucial. IT skills help in managing financial data, automating processes, and ensuring data accuracy and security.

9. Risk Management:

CAs need to identify, assess, and mitigate financial risks. This involves understanding risk management frameworks, conducting risk assessments, and developing strategies to protect the organization’s assets and reputation.

10. Mergers and Acquisitions (M&A) Expertise:

Knowledge in M&A is valuable for evaluating potential deals and conducting due diligence. CAs analyze financial statements, assess the value of companies, and help structure transactions to maximize shareholder value.

Conclusion:

These technical skills enable CAs to manage financial information, ensure regulatory compliance, and provide strategic financial insights that drive business success.