CA Intern

CA

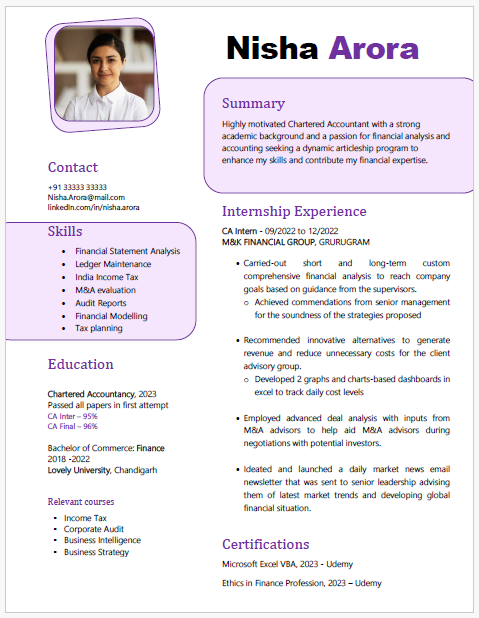

About this template

This is a very professional resume which can significantly enhance your job prospects.

This template is made in MS Word so, users can easily customize it to fit their specific needs.

Some most common interview questions for CA

For Chartered Accountants (CAs), interviews often delve into technical expertise, ethical considerations, and problem-solving capabilities. Here are ten common interview questions that assess a range of crucial skills for a CA:

1. Can you explain a complex financial concept to someone who isn't familiar with finance?

This question tests your ability to communicate complex information clearly and effectively. Highlight how you simplify complex financial data into understandable terms, demonstrating your communication skills.

2. How do you stay updated with changes in accounting standards and tax laws?

Employers want to know your commitment to professional development. Discuss specific resources such as continuing professional education (CPE) courses, seminars, or industry journals that you utilize to stay informed.

3. Describe a time when you identified a significant error in a financial report. What did you do?

This question assesses your attention to detail and integrity. Explain the situation, how you identified the error, and the steps you took to correct it, highlighting your proactive approach and ethical standards.

4. How do you handle tight deadlines, especially during the busy tax season?

Your ability to manage time and stress is crucial. Describe techniques you use to prioritize tasks, manage time effectively, and ensure accuracy under pressure.

5. Can you provide an example of how you have helped improve the financial processes at a previous job?

This seeks insight into your initiative and problem-solving skills. Share specific improvements or innovations you implemented, such as automating a process or enhancing reporting accuracy.

6. What experience do you have with financial software and systems?

Technical proficiency is key. Detail your experience with accounting software like QuickBooks, SAP, or Oracle Financials, emphasizing any specific projects or complex tasks you have managed using these tools.

7. Have you ever faced a situation where you had to report unethical practices? How did you handle it?

This question evaluates your ethical judgment. Explain a scenario where you encountered unethical behavior, the steps you took to address it, and the outcome, underscoring your commitment to ethical standards.

8. What do you consider the most challenging aspect of being a CA and how do you manage it?

Understanding your self-awareness and coping mechanisms is important. Discuss a particular challenge, such as keeping up with regulatory changes or managing client expectations, and how you effectively address these challenges.

9. Describe your experience with budgeting and financial forecasting.

This tests your analytical skills. Provide examples of how you have developed budgets, forecasted financial outcomes, and the tools you used to achieve accurate forecasts.

10. How do you ensure accuracy and reliability in your work?

This question probes into your meticulousness and quality control practices. Discuss the procedures you follow to verify financial information and the checks and balances you use to maintain accuracy.

Conclusion:

These questions collectively evaluate a CA candidate's technical capabilities, ethical standards, communication skills, and ability to handle the practical challenges of the role effectively.