Chartered Accountant

Chartered Accountant

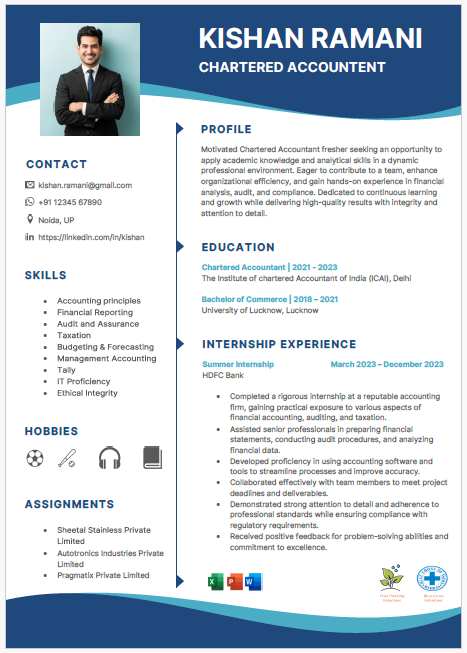

About this template

This is very modern and professional resume template for entry level candidates.

people can boost their confidence by using this eye catching and professional resume, it can helps to make good personality in front of interviewers.

Some common and useful Interview Question-answer for recent CA

Here are some common and useful interview questions for a recent Chartered Accountant (CA), along with suggested answers :

1. Can you tell us about yourself?

Answer : I recently qualified as a Chartered Accountant and have gained practical experience through my articleship at a reputable firm, where I worked on a variety of audits, tax filings, and financial analysis projects. I have a strong foundation in accounting principles and a keen eye for detail. I am now looking to apply my skills and knowledge in a dynamic organization where I can contribute to financial decision-making and process improvement.

2. Why did you choose a career in accounting?

Answer : I chose a career in accounting because I have always enjoyed working with numbers and solving complex problems. The structured nature of accounting, combined with the opportunity to provide valuable insights through financial analysis, really appeals to me. Additionally, accounting offers a clear career path with opportunities for continuous learning and professional growth.

3. What accounting software are you proficient in?

Answer : I am proficient in several accounting software packages, including Tally ERP, QuickBooks, and SAP. During my articleship, I also gained experience with advanced Excel functions and financial modeling. These tools have enabled me to streamline accounting processes, generate detailed reports, and conduct thorough financial analyses.

4. Can you explain the difference between accounts payable and accounts receivable?

Answer : Accounts payable refers to the money a company owes to its suppliers or creditors for goods and services received. It is a liability on the company's balance sheet. Accounts receivable, on the other hand, represents the money owed to the company by its customers for goods or services delivered. It is recorded as an asset on the balance sheet. Managing both effectively is crucial for maintaining healthy cash flow and financial stability.

5. How do you ensure accuracy in your work?

Answer : To ensure accuracy, I follow a systematic approach that includes double-checking entries, reconciling accounts regularly, and using software tools to validate data. I also stay updated with the latest accounting standards and regulations to ensure compliance. Additionally, I believe in maintaining a thorough review process where I cross-verify information with reliable sources and seek feedback from colleagues when necessary.

6. Describe a time when you identified and solved a significant accounting error.

Answer : During my articleship, I was reviewing a client’s financial statements and noticed an inconsistency in the inventory valuation. The figures did not match the actual physical inventory counts. I investigated further and discovered that the error was due to incorrect data entry during the year-end stock take. I corrected the entries and implemented a more robust inventory tracking system to prevent future discrepancies. This not only improved the accuracy of the financial statements but also enhanced the client’s inventory management process.

7. How do you stay updated with the latest accounting standards and regulations?

Answer : I stay updated with the latest accounting standards and regulations by regularly attending professional development courses and seminars. I am also an active member of professional accounting bodies, which provide access to the latest industry updates and publications. Additionally, I follow relevant financial news, subscribe to accounting journals, and participate in online forums and webinars.

8. How do you handle tight deadlines and multiple tasks?

Answer : I handle tight deadlines and multiple tasks by prioritizing my workload and using effective time management strategies. I start by breaking down complex tasks into smaller, manageable steps and setting realistic deadlines for each. I also make use of project management tools to track progress and stay organized. Communication is key, so I keep my team and supervisors informed about my progress and any potential bottlenecks. This approach helps me stay focused and ensures timely completion of all tasks.

9. Why do you want to work for our company?

Answer : I am impressed by your company’s reputation for innovation and commitment to excellence. I believe that my skills and experience align well with the needs of your organization. I am particularly excited about the opportunity to contribute to your financial team and help drive strategic decision-making. Your company’s culture of continuous improvement and professional development also resonates with my career aspirations.

10. What are your long-term career goals?

Answer : My long-term career goal is to become a finance manager or CFO, where I can play a key role in shaping the financial strategy of an organization. I aim to continue expanding my knowledge and skills, particularly in areas such as financial planning, risk management, and strategic decision-making. I am looking for a position that offers growth opportunities and the chance to make a significant impact on the company’s financial health.