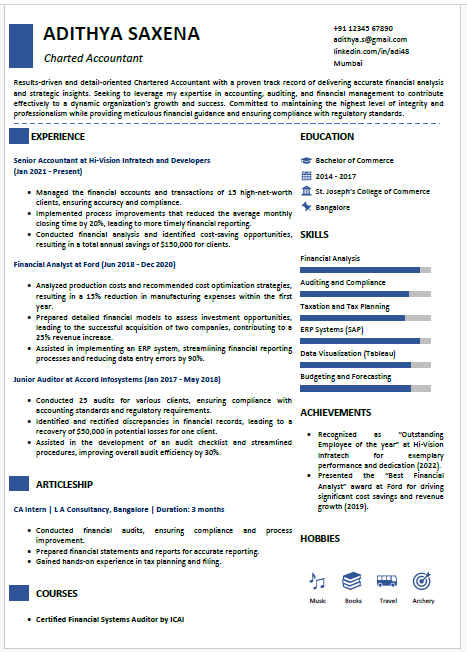

Charted Accountant

Charted Accountant

About this template

This is a very professional resume which can significantly enhance your job prospects.

This resume is made by MS Word, featuring a clean and modern layout designed to highlight your skills and achievements.

Some Important technical skills for chartered accountant

For Chartered Accountants (CAs), a robust set of technical skills is essential for managing complex financial tasks, ensuring compliance, and providing strategic advice. Here are ten important technical skills for a CA:

1. Advanced Accounting Knowledge:

Chartered Accountants must have a deep understanding of accounting principles, standards, and practices. This includes proficiency in preparing and analyzing financial statements, ensuring accurate representation of an organization’s financial position.

2. Taxation Expertise:

Expertise in taxation laws and regulations is crucial. CAs need to handle tax planning, compliance, and preparation of tax returns, as well as advise on tax-related matters to optimize tax liabilities and ensure regulatory compliance.

3. Auditing Skills:

Proficiency in auditing practices is vital. CAs conduct internal and external audits to evaluate financial systems, controls, and processes, ensuring accuracy and compliance with standards and regulations.

4. Financial Analysis:

The ability to analyze financial data and trends is important. CAs use financial analysis to assess performance, conduct risk assessments, and provide insights that support strategic decision-making.

5. Accounting Software Proficiency:

Familiarity with accounting software such as SAP, Oracle, or QuickBooks is essential. These tools help in managing financial records, generating reports, and automating accounting processes, enhancing efficiency and accuracy.

6. Budgeting and Forecasting:

Skills in budgeting and financial forecasting enable CAs to prepare detailed budgets, monitor financial performance, and predict future financial conditions. This helps in effective resource allocation and financial planning.

7. Regulatory Compliance:

Understanding and adhering to financial regulations and compliance standards is crucial. CAs ensure that financial practices and reporting meet legal requirements, minimizing risk and avoiding penalties.

8. Financial Reporting:

Proficiency in financial reporting involves preparing detailed reports for stakeholders, including management, investors, and regulatory bodies. Accurate and timely financial reports are essential for transparency and informed decision-making.

9. Risk Management:

The ability to identify, assess, and mitigate financial risks is important. CAs evaluate risk factors related to financial operations and implement strategies to manage and reduce potential risks.

10. Forensic Accounting:

Skills in forensic accounting are valuable for investigating financial discrepancies and fraud. CAs use forensic techniques to analyze financial records and provide evidence for legal proceedings if necessary.

Conclusion:

These technical skills enable Chartered Accountants to perform their roles effectively, ensuring financial accuracy, compliance, and strategic insight within their organizations.