Financial Analyst Fresher

MBA

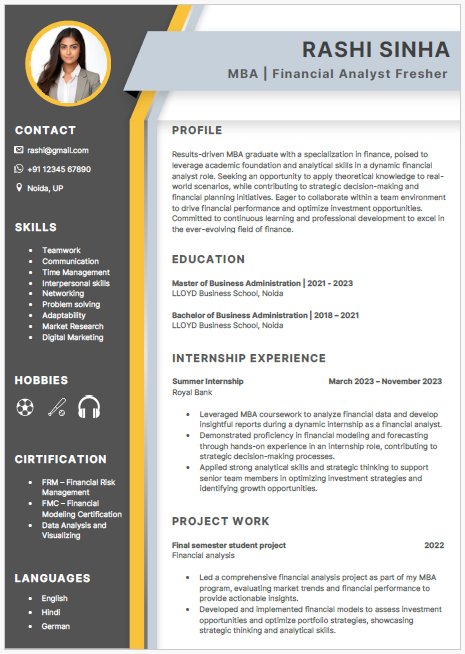

About this template

This is a very colorful and modern resume which can help you stand out from the competition.

Its vibrant design and well-organized layout effectively showcase your skills and achievements, making a lasting impression on potential employers.

Some most important and common interview questions for Financial Analyst Fresher

Here are some of the most important and common interview questions for a Financial Analyst Fresher, along with brief answers that highlight key skills:

1. How do you approach financial analysis?

Financial analysis requires a solid understanding of financial statements and key metrics. I start by gathering relevant data, analyzing trends, and using financial ratios to assess a company’s performance. My analytical skills help in making data-driven decisions.

2. What financial software are you familiar with?

Proficiency in financial software is essential for efficiency. I am familiar with tools like Excel, SAP, and QuickBooks, which I use for data analysis, financial modeling, and reporting. My technical skills enable me to manage large datasets and generate insightful reports.

3. How do you stay updated on financial markets and trends?

Staying informed is crucial for a Financial Analyst. I regularly follow financial news, read market reports, and attend webinars. My commitment to continuous learning ensures I’m aware of market dynamics and can anticipate potential impacts on financial decisions.

4. Can you explain a time when you worked with financial data?

Working with financial data requires accuracy and attention to detail. In my academic projects, I analyzed financial statements, performed ratio analysis, and prepared reports. My experience has honed my ability to interpret complex data and present it in a clear, actionable format.

5. What do you understand by financial modeling?

Financial modeling involves creating a representation of a company's financial performance. I’ve developed basic models during my coursework, projecting future revenues, costs, and profitability. My skills in financial modeling help in forecasting and scenario analysis.

6. How do you ensure the accuracy of your financial analysis?

Accuracy is paramount in financial analysis. I double-check my data sources, verify calculations, and use cross-referencing techniques. My attention to detail minimizes errors and ensures the reliability of my analysis.

7. What is your understanding of valuation methods?

Valuation methods are key in assessing a company’s worth. I am familiar with techniques such as Discounted Cash Flow (DCF) and Comparable Company Analysis (CCA). My knowledge of these methods helps in evaluating investment opportunities.

8. How do you handle large datasets?

Handling large datasets requires organization and efficiency. I use tools like Excel to clean, organize, and analyze data. My ability to manage and interpret extensive data sets allows me to extract valuable insights that support business decisions.

9. Describe your experience with financial reporting.

Financial reporting involves preparing accurate and timely reports. I’ve gained experience in creating financial statements during internships, ensuring compliance with accounting standards. My skills in financial reporting help in presenting data clearly to stakeholders.

10. How do you prioritize tasks when working on multiple projects?

Prioritization is essential in a fast-paced environment. I assess tasks based on deadlines and importance, using tools like to-do lists and project management software. My time management skills ensure that I meet deadlines while maintaining high-quality work.