Financial Analyst

MBA

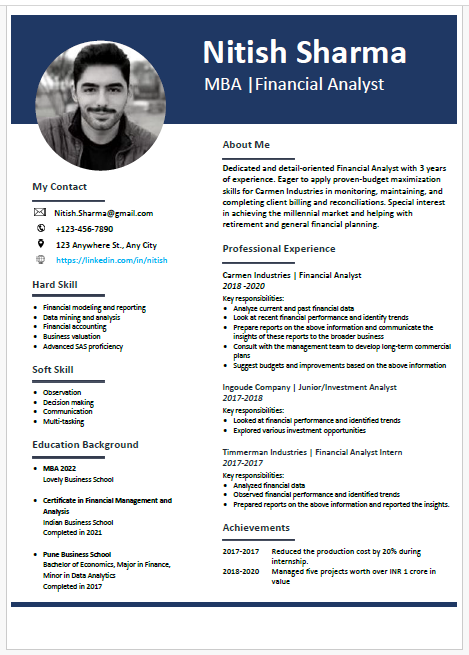

About this template

This resume is tailored to make a strong impression and increase your chances of landing your desired job.

Its clean design ensures easy readability, making it easier for recruiters to quickly assess your qualifications.

Some important and useful technical skills for MBA - Financial analyst

For an MBA Financial Analyst, a comprehensive set of technical skills is vital for effective financial analysis and decision-making. Here are ten important technical skills for this role:

1. Financial Modeling:

Proficiency in financial modeling involves creating detailed representations of a company's financial performance. Skills in Excel or specialized software to build models for forecasting, budgeting, and valuation are essential for making informed financial decisions.

2. Advanced Excel Skills:

Advanced Excel skills are crucial for analyzing large datasets and performing complex calculations. Expertise in functions, pivot tables, and macros allows for efficient data manipulation and insightful financial analysis.

3. Data Analysis:

Data analysis skills are important for interpreting financial data and trends. Knowledge of statistical tools and techniques, along with the ability to use data visualization software, helps in deriving actionable insights from financial reports.

4. Financial Reporting:

Understanding and preparing financial reports, including income statements, balance sheets, and cash flow statements, is key. This skill ensures accurate and timely reporting of financial performance to stakeholders.

5. Valuation Techniques:

Expertise in valuation techniques, such as discounted cash flow (DCF) analysis and comparable company analysis, is crucial for assessing the worth of investments and business opportunities.

6. Accounting Principles:

A solid grasp of accounting principles, including GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), is essential for accurate financial reporting and compliance.

7. Statistical Analysis:

Skills in statistical analysis help in understanding financial patterns and trends. Proficiency in tools like R or SAS enables the analyst to conduct regression analysis, hypothesis testing, and other statistical evaluations.

8. Financial Software Proficiency:

Familiarity with financial software and tools, such as Bloomberg Terminal, SAP, or QuickBooks, enhances efficiency in data management and financial analysis. These tools assist in streamlining financial processes and reporting.

9. Risk Management:

Understanding risk management principles and techniques is important for identifying and mitigating financial risks. Skills in assessing market risks, credit risks, and operational risks are crucial for safeguarding financial assets.

10. Investment Analysis:

Proficiency in investment analysis involves evaluating investment opportunities and making recommendations based on financial metrics and market conditions. Knowledge of portfolio management and asset allocation strategies is also important.

Conclusion:

These technical skills enable MBA Financial Analysts to perform detailed financial analysis, support strategic decision-making, and contribute to the financial health of an organization.