Financial Analyst

MBA, Finance

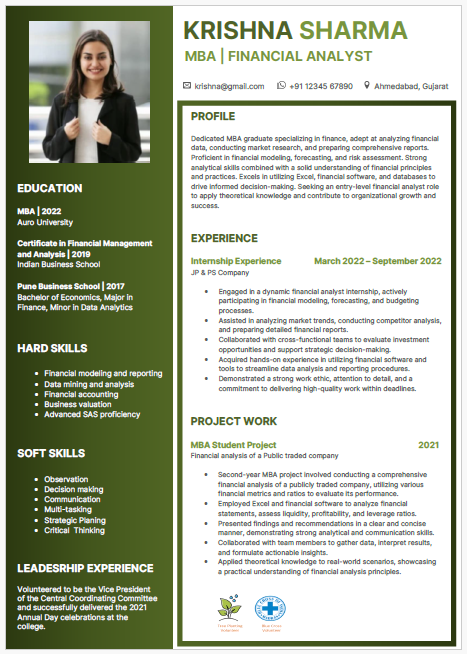

About this template

This is very modern, colorful and eye catching resume template.

This is well-designed resume which can make a significant difference in capturing the attention of hiring managers and landing your dream job.

Some important interview questions for MBA Financial analyst

Here are some important interview questions for MBA Financial Analysts, along with suggested answers :

1. Can you explain your experience with financial modeling?

During my MBA program, I gained extensive experience in financial modeling, building complex models for various projects such as valuation, budgeting, and forecasting. I used Excel and other financial software to analyze data, create projections, and evaluate different financial scenarios.

2. How do you stay current with financial news and trends?

I stay updated by reading financial publications like The Wall Street Journal, Financial Times, and Bloomberg. I also follow relevant finance blogs, participate in webinars, and attend industry conferences to keep abreast of the latest trends and developments.

3. Describe a time when you had to analyze a large set of financial data. How did you approach it?

In one of my internships, I was tasked with analyzing a large dataset to identify cost-saving opportunities. I began by cleaning the data and organizing it into a structured format. Then, I used pivot tables and advanced Excel functions to identify patterns and trends, providing actionable insights to the management team.

4. How do you handle tight deadlines and multiple projects?

I prioritize tasks based on urgency and impact, break projects into manageable parts, and set clear timelines for each part. Effective time management and regular progress tracking help me stay on top of deadlines. I also communicate proactively with stakeholders to manage expectations and ensure timely delivery.

5. What financial software and tools are you proficient in?

I am proficient in Microsoft Excel, including advanced functions and VBA for automation. I also have experience with financial analysis tools like Bloomberg Terminal, SAP, and QuickBooks, as well as data visualization tools like Tableau for presenting insights.

6. Can you describe your experience with budgeting and forecasting?

During my MBA, I worked on several projects involving budgeting and forecasting. I developed detailed budgets, monitored actual performance against projections, and adjusted forecasts based on changing conditions. This experience helped me understand the importance of accurate financial planning and analysis.

7. What are some key financial metrics you focus on when analyzing a company's performance?

I focus on metrics such as revenue growth, profit margins, return on equity (ROE), return on assets (ROA), and debt-to-equity ratio. These metrics provide a comprehensive view of a company’s financial health, operational efficiency, and overall performance.

8. How do you ensure accuracy in your financial analysis?

Ensuring accuracy involves double-checking calculations, using reliable data sources, and following standardized procedures. I also conduct sensitivity analyses to understand the impact of different assumptions and review my work with peers or mentors for additional scrutiny.

9. Describe a challenging financial analysis project you worked on. How did you handle it?

In a consulting project, I had to value a start-up with limited historical data. I used a combination of discounted cash flow (DCF) analysis and comparable company analysis, adjusting for the start-up’s unique risks and growth prospects. Collaborating with the client and my team, we developed a robust valuation model that guided investment decisions.

10. What long-term goals do you have as a financial analyst?

My long-term goal is to become a senior financial analyst or a financial manager, where I can lead strategic financial planning and analysis efforts. I aim to continually develop my skills, stay updated with industry trends, and contribute to making informed financial decisions that drive business growth.