Financial Analyst

MBA, Finance

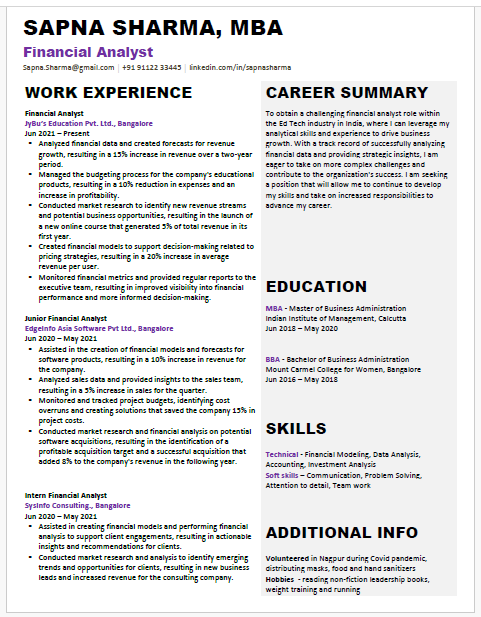

About this template

This is a very simple and professional resume which can effectively highlight your skills and experiences in a clear and concise manner.

Its clean design ensures easy readability, making it easier for recruiters to quickly assess your qualifications. This resume is tailored to make a strong impression and increase your chances of landing your desired job.

Some important and useful technical skills for MBA Financial Analyst

An MBA Financial Analyst requires a diverse set of technical skills to analyze financial data, support decision-making, and provide strategic recommendations. Here are ten important and useful technical skills :

1. Financial Modeling :

Proficiency in financial modeling involves creating detailed financial models to forecast company performance, assess investment opportunities, and support valuation. This skill is crucial for analyzing various financial scenarios and outcomes.

2. Excel Proficiency :

Advanced Excel skills are essential for data analysis, financial modeling, and creating complex spreadsheets. Knowledge of functions, pivot tables, and macros enhances efficiency and accuracy in financial analysis.

3. Data Analysis :

Data analysis skills enable Financial Analysts to interpret financial and operational data, identify trends, and provide insights. Familiarity with data analysis tools like R, Python, or SQL is increasingly valuable in this role.

4. Valuation Techniques :

Understanding various valuation methods, such as discounted cash flow (DCF), comparable company analysis, and precedent transactions, is crucial for assessing the value of assets, companies, or investments.

5. Accounting Knowledge :

A strong grasp of accounting principles and financial statements is essential for analyzing a company's financial health, understanding cash flows, and evaluating financial performance.

6. Financial Reporting :

Skills in financial reporting involve preparing accurate and comprehensive financial reports for stakeholders, including management, investors, and regulatory bodies. This includes understanding GAAP or IFRS standards.

7. Risk Management :

Knowledge of risk management techniques allows Financial Analysts to identify and assess financial risks, develop risk mitigation strategies, and ensure compliance with regulatory requirements.

8. Statistical Analysis :

Proficiency in statistical analysis is useful for analyzing market data, performing quantitative research, and building predictive models. This skill helps in making data-driven investment and business decisions.

9. Investment Analysis :

Skills in investment analysis involve evaluating securities, bonds, and other investment opportunities. Financial Analysts use this expertise to recommend portfolio strategies and optimize returns.

10. Software Proficiency :

Familiarity with financial software and tools, such as Bloomberg Terminal, SAS, SPSS, or financial databases, is important for accessing real-time market data, conducting research, and analyzing financial metrics.

Conclusion :

These technical skills equip MBA Financial Analysts with the tools and knowledge needed to analyze complex financial data, provide valuable insights, and support strategic decision-making in various business contexts.