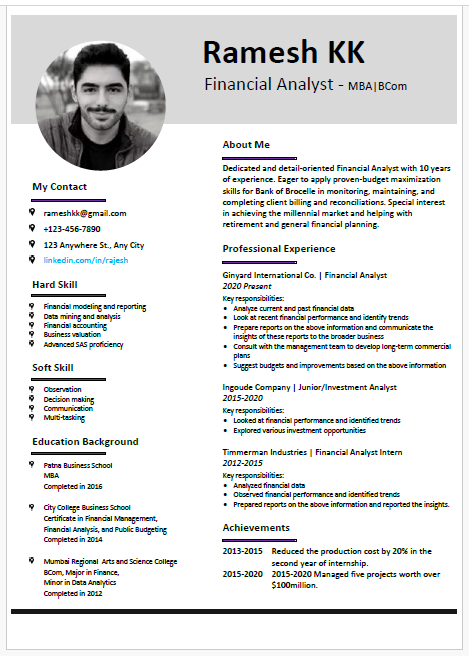

Financial Analyst

MBA

About this template

This is a very professional resume which can significantly enhance your job prospects.

With its clean, modern design and industry-tailored layout, it highlights your skills and achievements, making a strong impression on recruiters.

Some important and useful technical skills for financial analyst

Financial analysts need a robust set of technical skills to evaluate financial data, create forecasts, and provide actionable insights. Here are ten important and useful technical skills for financial analysts:

1. Financial Modeling:

Proficiency in financial modeling is crucial for creating detailed representations of financial scenarios. Analysts use tools like Excel to build models that project financial performance, evaluate investment opportunities, and support decision-making processes.

2. Advanced Excel Skills:

Excel is a fundamental tool for financial analysts. Advanced skills include using functions like VLOOKUP, INDEX-MATCH, pivot tables, and macros to manipulate data, conduct analysis, and automate repetitive tasks, enhancing efficiency and accuracy.

3. Data Analysis and Interpretation:

Strong data analysis skills enable analysts to interpret financial data and trends. This involves understanding metrics like ROI, EBITDA, and profit margins, and using statistical tools to derive insights from complex datasets.

4. Financial Reporting:

Expertise in financial reporting involves preparing accurate financial statements, including income statements, balance sheets, and cash flow statements. Analysts must understand accounting principles and regulatory requirements to ensure compliance and transparency.

5. Knowledge of Financial Software:

Familiarity with financial software such as SAP, Oracle, Bloomberg Terminal, and QuickBooks is essential for data management, financial analysis, and reporting. These tools help analysts access real-time data, track financial transactions, and generate reports.

6. Valuation Techniques:

Understanding various valuation methods, including discounted cash flow (DCF), comparable company analysis, and precedent transactions, is vital for assessing the value of assets, companies, and investment opportunities.

7. Risk Analysis and Management:

Skills in risk analysis help analysts identify potential financial risks and assess their impact. They use tools like scenario analysis and sensitivity analysis to evaluate the effects of market changes, interest rates, and other variables on financial outcomes.

8. Budgeting and Forecasting:

Financial analysts often create budgets and forecasts to project future financial performance. This requires analyzing historical data, market trends, and economic indicators to make informed predictions and set financial goals.

9. Understanding of Financial Markets:

A thorough understanding of financial markets, including equity, debt, and derivatives markets, is crucial. Analysts must be able to interpret market movements, economic indicators, and financial news to make informed investment recommendations.

10. Regulatory Knowledge:

Familiarity with financial regulations and standards, such as GAAP or IFRS, is essential for ensuring compliance and accuracy in financial reporting. Analysts must stay updated on regulatory changes that can impact financial practices and reporting requirements.

Conclusion:

These technical skills enable financial analysts to conduct thorough analyses, support strategic decision-making, and provide valuable insights that drive business success.